CAPTURING BETTER

CUSTOMERS THROUGH

MESSAGE TESTING

SUMMARY

Through brand and product messaging tests on Facebook, I helped Root capture customers with 2-4x higher lifetime premium values (total dollar amount customer pays Root Insurance).

ROLE

Concept, Copy, Art Direction, Strategy

BACKGROUND

As an insurance-tech start-up, Root Car Insurance was in full growth mode, which meant running paid media that brought in the most conversions (customer profiles).

The brand’s main savings message, “Save Up To 52%”, had the highest conversion rate and so was the most used across all creative and paid media channels.

THE CHALLENGE

As the company matured, it was observed that a large portion of Root’s new customers were leaving after only a few months. This was creating havoc for Root’s business goals, with Root suddenly missing out on precious months of customer premium it had initially counted on.

Root needed to figure out a way to bring in customers who were going to keep their policies for at least 8-12 months. But what did those customers look like and how could we reach them?

UNDERSTANDING ROOT’S CUSTOMERS

The Consumer Insights team dove into the problem and after combing through market research and customer data, discovered there were roughly three consumer segments Root was targeting.

Super Savers

Drivers who only care about saving as much as possible month-to-month.

Modest Mavericks

Drivers who are attracted to features and conveniences, while still being somewhat considerate of price.

Loyalists

Drivers who are devoted to their current insurance carriers and have a very low chance of switching.

CONCLUSION

So the “52% Savings” message was working great at getting a high volume of customers in the door, but the majority of those customers were unfortunately Super Savers. And at the first sign of a cheaper rate somewhere else, they were leaving Root.

THE PLAN: GO AFTER

THE MAVERICKS

The team knew then that despite high customer volume, Root needed to shift away from savings-focused messaging in favor of ones that attracted better customers.

The Analytics team had quantified better customers as having higher average Lifetime Premium values (aLTP), calculated through Root’s customer data models. Breaking down Root’s customer mix then by aLTP, those who indicated Super Savers traits had the lowest values, Mavericks were the middle ground, and Loyalists were the highest.

Since we knew Loyalists were unlikely to switch from their carrier, the goal became to go after the Mavericks. Working closely with Root’s Facebook channel managers and data warehouse team, we developed a Facebook test plan.

Goal:

Discover if any brand messaging resonates with Mavericks and is profitable to pursue.

Test Details:

Conduct two A/B tests on Facebook with 5 static assets in each test. Each asset will focus on a different brand message/USP. Using customer data models, we’ll look at the mix of customers each asset brings in and their projected average Lifetime Premium (aLTP).

Hypothesis:

If Mavericks appeal to other messaging such as ones covering insurance features and convenience as we suspect, conversions from those ads should have higher projected aLTP numbers than the Savings ads.

KPIs:

aLTP per static ad, Impressions, CPC (Cost Per Conversion), Conversions

FACEBOOK STATIC ADS

FOR TEST

COPY

I first built out a grid of all of Root’s brand messaging, app features and sales props, then narrowed it down to the strongest 10 from what we had already tested. From there, I wrote most of the headline and body copy, keeping a conversational tone used most often by the brand.

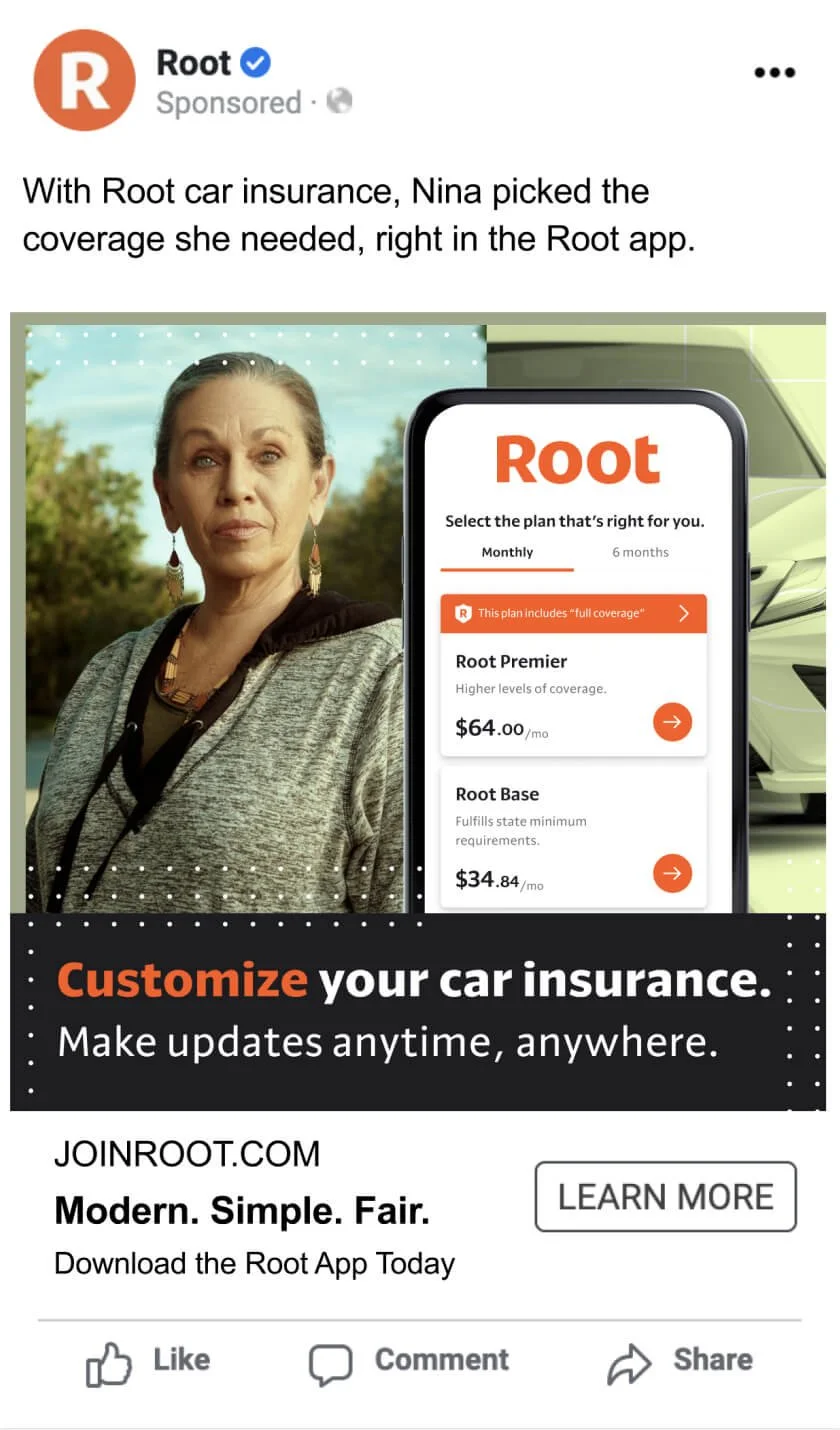

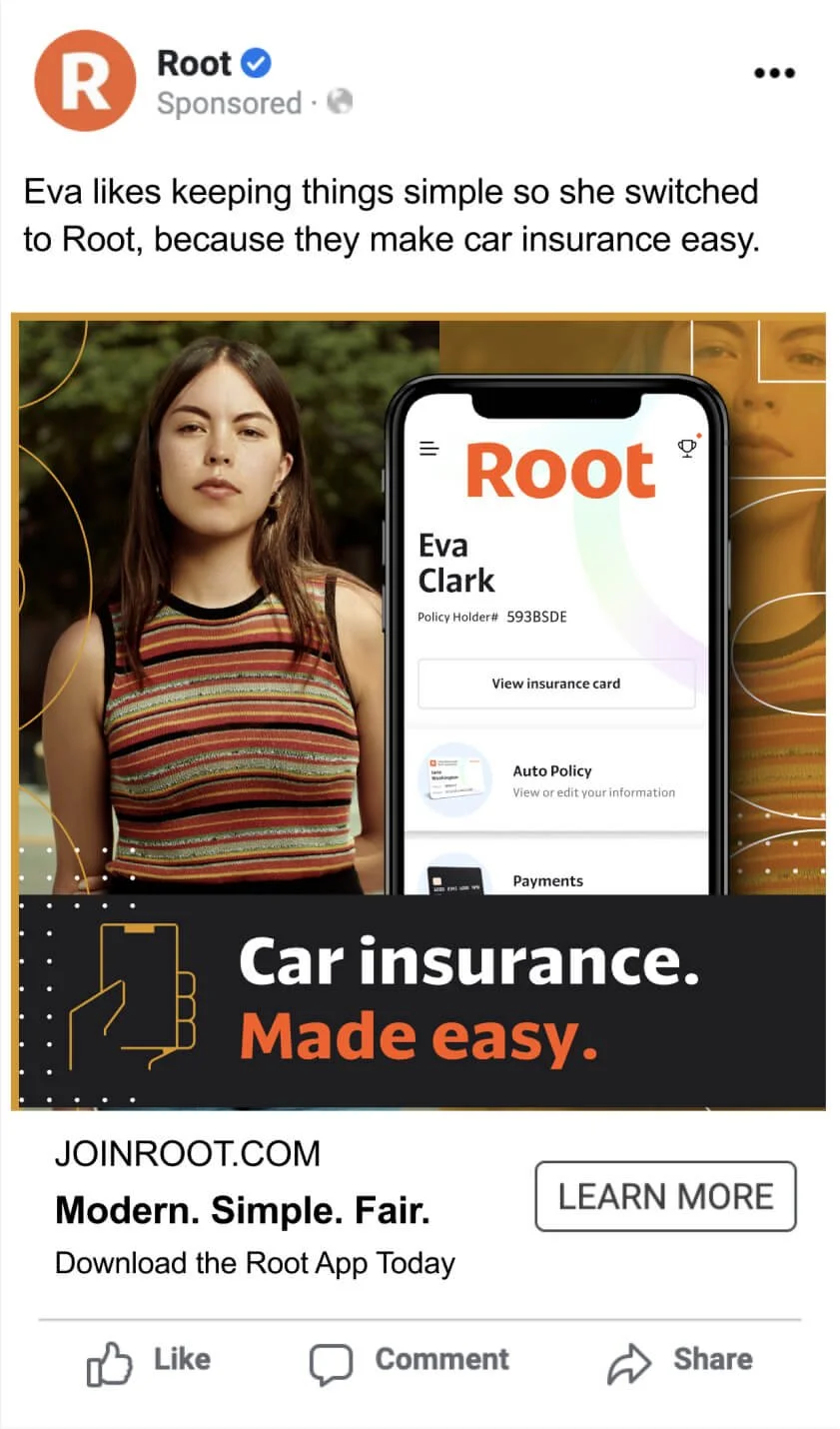

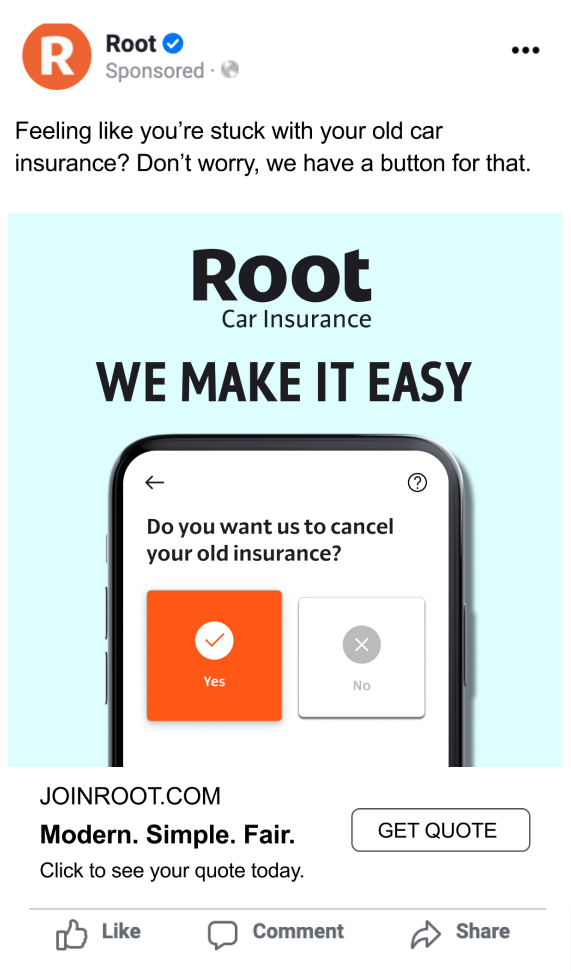

DESIGN

My team based the final layout from similar successful static ads already in use, so we knew the design would attract clicks. The biggest challenge here was to make sure the app screenshots complimented the ad’s message without introducing another sales prop in order to obtain cleaner results.

DEBATE OVER PHOTOS

The brand team wanted us to use a new set of portrait photos for the test. Although this was adding another variable to the statics (vs. having the same portrait for all of them), previous tests had shown that overall layout and messaging mattered most for conversions, with specific imagery changes (different color palettes / photos) usually having little to no effect. So it was decided to move forward using the new photo series.

Fast claims

Customize your coverage

Customer service

Same day insurance

Good driving

Roadside assistance

Savings

Social proof

Easy car insurance

Fairness

RESULTS

2-4x more aLTP

The Savings and Same Day Sign-up ads brought in slightly more total conversions than Easy Car Insurance and Roadside Assistance (in line with what Root had seen). But, Easy and Roadside had brought in customers with 2-4x more aLTP than Savings at just a slightly higher CPC (cost per conversion/profile).

The team had discovered by spending just a little more upfront, Mavericks could be acquired with easy-based messaging and specific feature-focused assets at a much more profitable rate in the long run.

More digging needed to be done, but this was the first step towards pivoting away from “Save up to 52%”, and exploring the full potential of “Car insurance made easy”.

WINNERS

Easy, Roadside Assistance

WORST aLTP to CPC

Savings, Same Day Sign-up

APPLYING LEARNINGS

After the test, my team and I began to apply the winning messaging to other Facebook static designs running at the time, as well as start experimenting with message combinations, such mixing Easy and Fairness.

These were remarketing ads I designed, again focusing on Easy and Features, meant to go after the Mavericks that had interacted with Root but had not yet created a profile.